10 Simple Techniques For Clark Finance Group Mortgage Broker

Table of ContentsFacts About Clark Finance Group Mill Park RevealedThe Best Strategy To Use For Mortgage BrokerUnknown Facts About Home Loan CalculatorClark Finance Group Home Loan Lender Fundamentals Explained

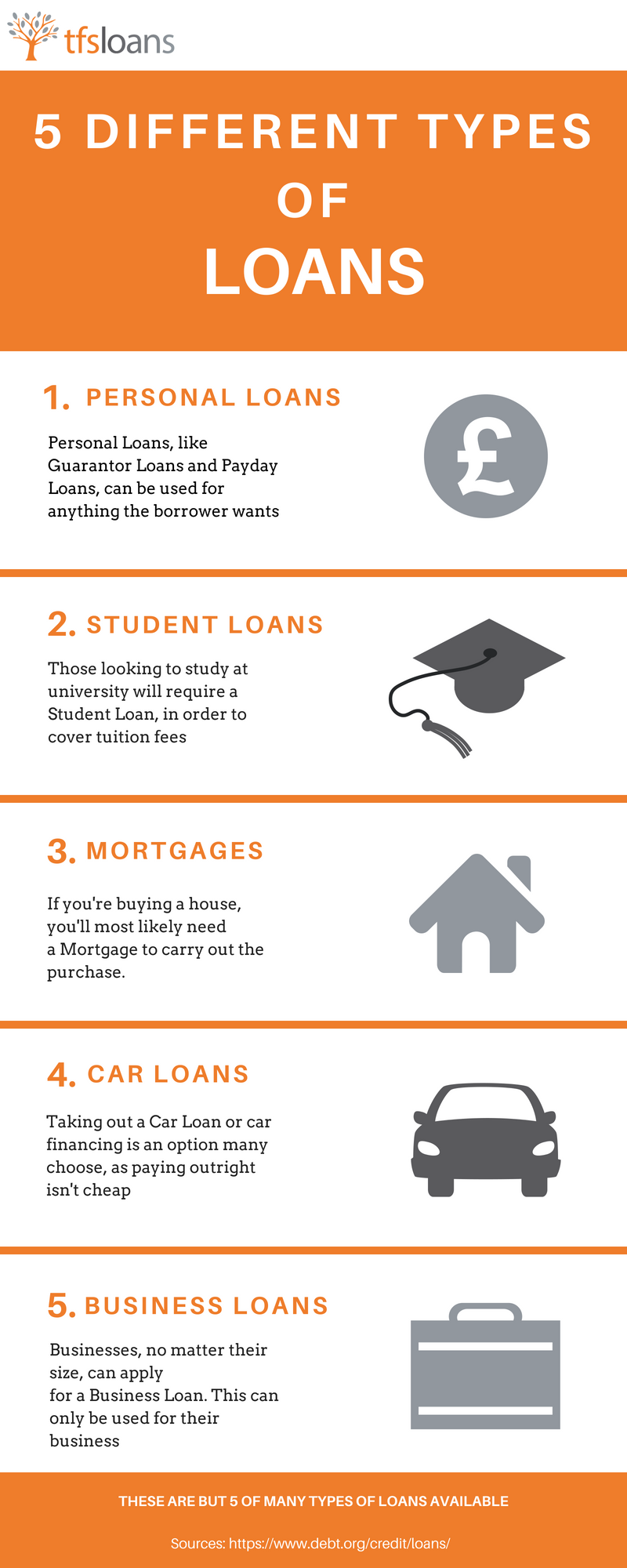

Sorts of Finances, Individual fundings - You can get these loans at nearly any kind of bank. The bright side is that you can usually invest the cash however you like. You could go on vacation, buy a jet ski or obtain a brand-new tv. Personal loans are commonly unsafe and relatively simple to obtain if you have average credit rating.These finances are safeguarded by the house or property you are purchasing. That suggests if you don't make your payments in a timely way, the financial institution or lender can take your house or residential property back! Mortgages help people enter into houses that would certainly or else take years to conserve for. They are often structured in 10-, 15- or 30-year terms, as well as the rate of interest you pay is tax-deductible and also rather reduced contrasted to various other loans.

The equity or financing quantity would certainly be the distinction in between the assessed value of your home and the quantity you still owe on your home mortgage. These financings benefit house additions, residence enhancements or financial obligation loan consolidation. The passion price is typically tax deductible and likewise fairly reduced compared to various other financings.

They do need a bit even more work than normal and also commonly need a company strategy to show the validity of what you are doing. These are usually safe fundings, so you will need to pledge some individual possessions as security in situation the company falls short. Advantages of Loans, Organization growth and also expansion - Lendings are a fantastic means for a company to increase as well as expand quicker than it otherwise could.

The smart Trick of Home Loan Calculator That Nobody is Talking About

Interest - Paying simply the interest on numerous car loans can end up setting you back people tens of hundreds of dollars a year. One loan may be workable, however include a residence loan, two automobile finances, pupil lendings and also a couple of credit scores card advances into the mix, and also the interest can leave control really promptly.

You do it as well lots of times, and the financial institution or loan provider can lawfully repossess your home that you have actually been paying on for 10 years! Lesson Summary, A financing is when you receive money from a friend, bank or economic organization in exchange for future settlement of the principal and also rate of interest.

The Best Guide To Mortgage Broker

Individual lendings provide you quick, adaptable access to funds that can be more tips here utilized for several major life events, expenditures or settling debt, all with one fixed month-to-month repayment. Combine charge card debt Simplify your monthly expenses by consolidating your high passion financial obligation Restore your house Update your living area without utilizing your house as security Acquisition or repair a vehicle Store for the most effective finance price and purchase or repair your auto anywhere Take a vacation Financing your whole trip or utilize it for investing cash Fund your wedding event Spread the cost of your big day over months or years Cover medical expenditures Cover unforeseen costs or intended treatments.

It's usually a percentage of the lending added on top of what you already owe. look here 1 As for how much passion you'll pay, there are various rate of interest rates for different types of finances.

The tricky part of looking for a financing comes when you begin looking for kinds of customer lendings. As you find out concerning fundings, obtaining to understand essential phrases and also terms can help you discover the best kind for you.

Kinds of bank loan Typical or term lendings A term funding, which is likewise described as a conventional finance, is financing obtained from a bank that has to be paid off over a collection duration of time. This can be either a brief or extended period, varying from a couple of months to several years.

The smart Trick of Clark Finance Group Home Loan Calculator That Nobody is Discussing

The most common type of SBA car loan is the SBA 7(a) finance. It has a maximum limitation of $5 million as well as is usually made use of to buy actual estate, as well as for working capital and financial obligation refinancing.

SBA microloans learn this here now are expanded as much as $5,000 with the purpose to help local business grow as well as purchase their working funding, supply, as well as devices. Devices financing lendings A devices financing loan is one that enables owners to purchase devices as well as equipment for their procedures. Businesses can utilize a finance toward workplace equipment and tools for workers or to make items.

Unlike various other fundings, organizations will require to make a down repayment prior to receiving the financing. The most common kind of SBA lending is the SBA 7(a) car loan.